Our specialized Corporate Finance team is ready to provide you with advice and management assistance in Mergers & Acquisitions and Private Placements.

M&A transactions

At Capital Flows, we specialize in assisting our clients, through advice and/or management, with M&A transactions such as purchases, sales, mergers, business partnerships, and shareholder plans. We focus on medium-sized companies, incoming and outgoing foreign investments, and national business combinations.

There are many reasons why a company may consider a M&A transaction, from expanding into new markets to acquiring new capabilities and diversifying their portfolio of products and services. There may also be financial reasons, such as selling a company that is experiencing financial difficulties or acquiring a company to improve profitability.

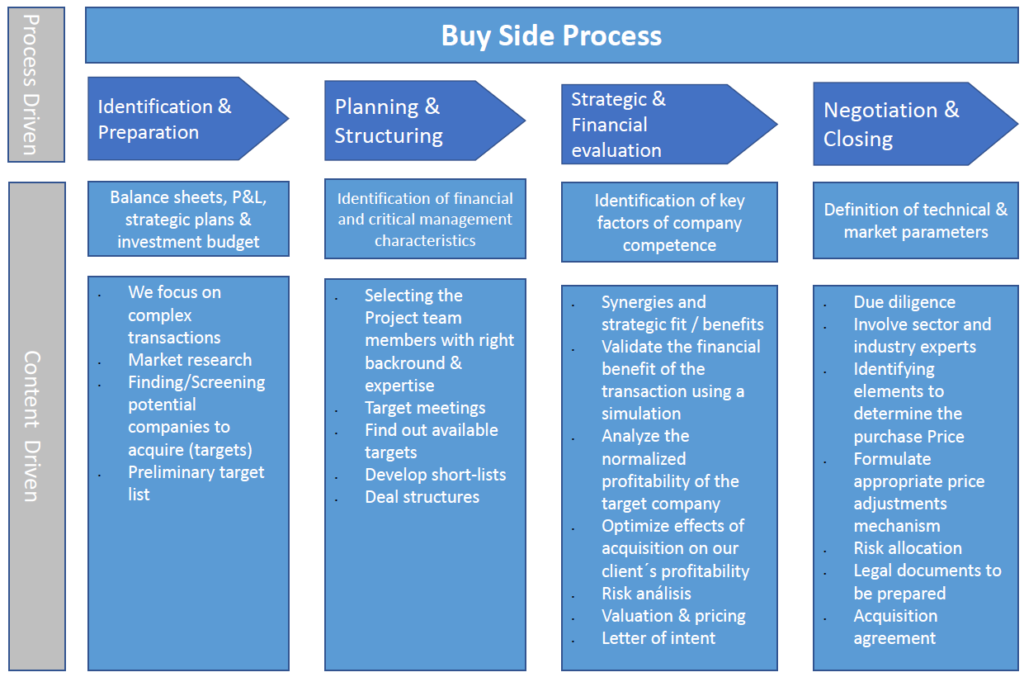

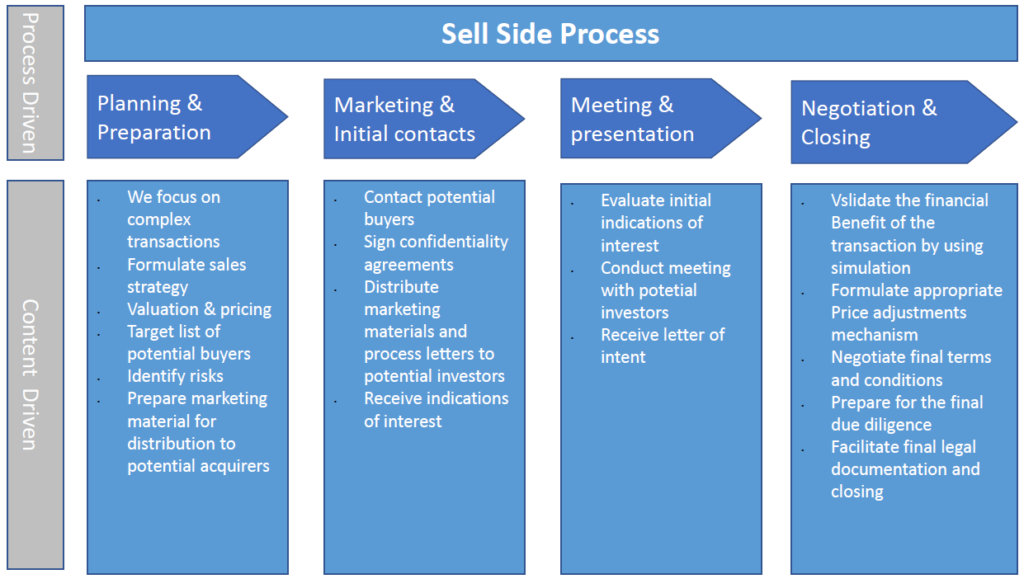

It is important to carefully assess the reasons and objectives behind any M&A transaction, as it can have a significant impact on the future of the company and its employees. At Capital Flows, we ensure that the M&A process is systematic, and all necessary stages and actions are fulfilled to optimize the benefits

derived from the transaction. See the charts below for more information on the tasks that need to be developed in an M&A transaction.

.

In our M&A advisory and management service, we tailor our level of involvement to the specific needs and internal resources of each client. Our team can provide comprehensive advice and /or management on all stages of buying or selling a company, from planning and valuation to negotiation and transaction closure.

At Capital Flows, we understand that each M&A transaction is unique and requires a bespoke approach. We work closely with our clients to understand their objectives and ensure that our recommendations are aligned with their long-term business strategy.

Whether you need support throughout the entire M&A process or just a specific part of it, we are committed to providing you with high-quality service and expert advice at every stage of your transaction.

Private Placement

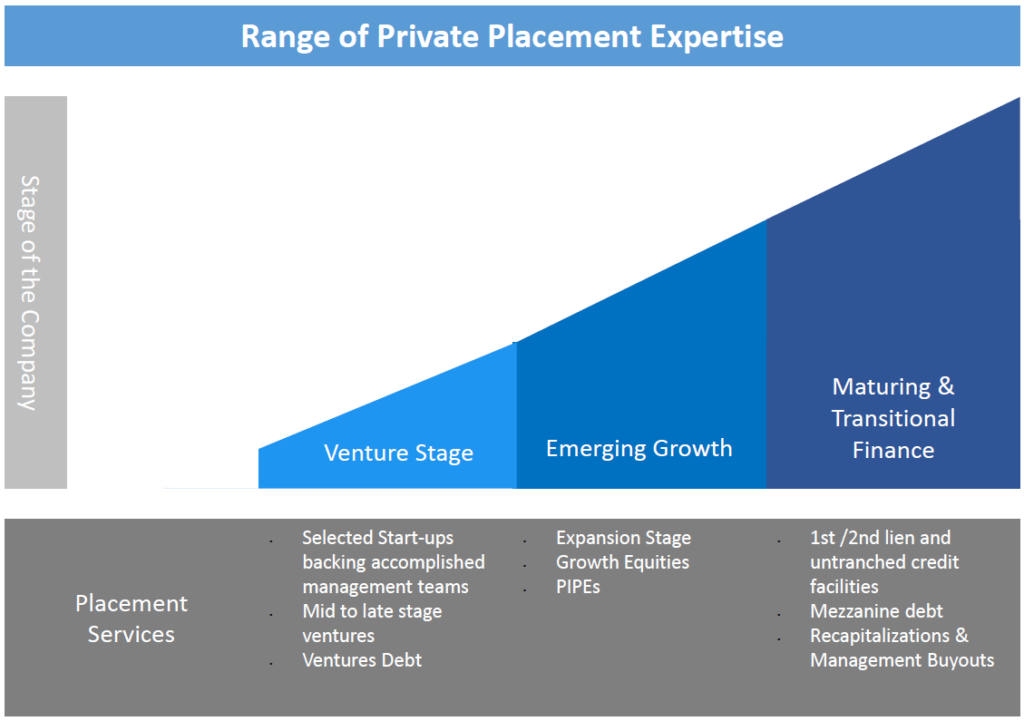

At Capital Flows, we offer private placement services that cover the entire lifecycle of a company, from raising equity to debt financing. Our experience is backed by strong relationships with investors and a track record of success in a variety of transactions. We tailor our services to the specific needs of each client, considering their stage of growth and development, as shown in the following chart.

When a company seeks to carry out a private capital placement, that is, the sale of shares or ownership stakes to a select group of investors, it may require various financial services to achieve its goal. Some of the services that may be necessary in a private capital placement for a growing company include: financial advice to determine the structure of the transaction, the price of shares or ownership stakes, and the identification of appropriate investors. An evaluation may also be required to determine the value of the company and establish a fair price for the stakes. All of this necessarily involves the preparation of legal and financial documents, such as subscription agreements, marketing documentation, and financial reporting. Marketing and promotion require expert advice in reaching the appropriate investors, after which the company may need assistance in coordinating the offer, allocating shares or ownership stakes, and closing the transaction.

Valuations

At Capital flows, we offer valuation services for assets, companies, and properties. Our clients typically require these services for buying and selling assets, mergers and acquisitions, financial planning, regulatory compliance, or legal disputes.

The purpose of the valuation is to provide a fair, accurate, and objective estimate of the value of an asset or company at a specific point in time. Valuations help investors, owners, regulators, accountants, and other stakeholders make informed and objective decisions about the asset or company in question.

The scope of the valuation typically involves gathering relevant information about the asset or company, analyzing financial and operational data, identifying factors that may affect its value, and applying an appropriate valuation method to calculate its financial worth. Valuation methods may include the income approach, market approach, and cost approach. Depending on the purpose of the valuation, one or more methods may be used to obtain a fair and reasonable estimate of the asset’s or company’s value.